Step by step instructions to Explore Assessment Ramifications of Disc Rates

Putting resources into Testaments of Store (Discs) is a conservative method for developing your reserve funds; notwithstanding, it's fundamental to comprehend the assessment suggestions connected with Cd interest pay. By and large, the premium acquired from Cds is viewed as available pay, yet a few systems can assist you with upgrading your expense circumstance. This complete aide will investigate these systems and help you in exploring the duty ramifications of Cd premium successfully. Thusly, you can limit your taxation rate and expand your after-assessment forms.

Premium Detailing: One urgent perspective to consider in regards to Album rates and charges is the precise revealing of revenue pay. The premium you procure from Cds is ordinarily answered to the Inner Income Administration (IRS), and you will get a Structure 1099-INT from your bank. It's indispensable to precisely report this pay on your expense form, as neglecting to do so can prompt punishments from the IRS, making consistence with charge revealing necessities fundamental.

Charge Advantaged Records: To upgrade your assessment circumstance with Albums, consider putting resources into charge advantaged accounts like Individual Retirement Records (IRAs) or 401(k)s. These records give different tax reductions that can work with abundance development. For example, customary IRAs and 401(k)s offer assessment conceded development, importance charges on interest are just due upon withdrawal in retirement. Then again, Roth IRAs give tax-exempt withdrawals. By putting resources into Discs inside these expense advantaged accounts, you can appreciate critical tax reductions and possibly bring down your general assessment obligation.

Compact discs for Momentary Objectives: For transient monetary desires, consider putting resources into Cds inside a customary bank account or a currency market account. The premium gathered in these records might be dependent upon better duty treatment or a lower charge rate contrasted with standard Discs. These records can act as a duty proficient technique to accomplish momentary monetary targets while possibly decreasing your expense responsibility.

State Assessments: Know that specific states force extra expenses on interest pay. State charge regulations can differ generally, so exploring your state's duty guidelines is fundamental to appreciate any beneficial assessment suggestions in regards to Cd interest pay. Understanding your state's duty regulations empowers you to go with informed speculation decisions and actually deal with your assessment commitments.

Compact disc Development: as a general rule, the year your Cd develops is typically when you will be burdened on the premium procured. In the event that your venture procedure incorporates a Cd stepping stool with various Discs developing at various times, you can stun your duty obligation more than quite a while. This approach can assist with conveying your duty commitments and possibly bring down your general taxation rate.

Actually exploring the assessment ramifications of Cd rates permits you to limit your duty risk and boost your after-government forms. Using charge advantaged records like IRAs and 401(k)s, fathoming your state's assessment regulations, and utilizing methodologies like Compact disc laddering are basic strides for enhancing your duty circumstance. Informed navigation guarantees that your Cd speculations are as duty productive as could really be expected, empowering you to hold a greater amount of your well deserved reserves.

Premium Detailing: One urgent perspective to consider in regards to Album rates and charges is the precise revealing of revenue pay. The premium you procure from Cds is ordinarily answered to the Inner Income Administration (IRS), and you will get a Structure 1099-INT from your bank. It's indispensable to precisely report this pay on your expense form, as neglecting to do so can prompt punishments from the IRS, making consistence with charge revealing necessities fundamental.

Charge Advantaged Records: To upgrade your assessment circumstance with Albums, consider putting resources into charge advantaged accounts like Individual Retirement Records (IRAs) or 401(k)s. These records give different tax reductions that can work with abundance development. For example, customary IRAs and 401(k)s offer assessment conceded development, importance charges on interest are just due upon withdrawal in retirement. Then again, Roth IRAs give tax-exempt withdrawals. By putting resources into Discs inside these expense advantaged accounts, you can appreciate critical tax reductions and possibly bring down your general assessment obligation.

Compact discs for Momentary Objectives: For transient monetary desires, consider putting resources into Cds inside a customary bank account or a currency market account. The premium gathered in these records might be dependent upon better duty treatment or a lower charge rate contrasted with standard Discs. These records can act as a duty proficient technique to accomplish momentary monetary targets while possibly decreasing your expense responsibility.

State Assessments: Know that specific states force extra expenses on interest pay. State charge regulations can differ generally, so exploring your state's duty guidelines is fundamental to appreciate any beneficial assessment suggestions in regards to Cd interest pay. Understanding your state's duty regulations empowers you to go with informed speculation decisions and actually deal with your assessment commitments.

Compact disc Development: as a general rule, the year your Cd develops is typically when you will be burdened on the premium procured. In the event that your venture procedure incorporates a Cd stepping stool with various Discs developing at various times, you can stun your duty obligation more than quite a while. This approach can assist with conveying your duty commitments and possibly bring down your general taxation rate.

Actually exploring the assessment ramifications of Cd rates permits you to limit your duty risk and boost your after-government forms. Using charge advantaged records like IRAs and 401(k)s, fathoming your state's assessment regulations, and utilizing methodologies like Compact disc laddering are basic strides for enhancing your duty circumstance. Informed navigation guarantees that your Cd speculations are as duty productive as could really be expected, empowering you to hold a greater amount of your well deserved reserves.

LATEST POSTS

- 1

Creativity Revealed: A Survey of \Making Shocking Looks\ Cosmetics Item

Creativity Revealed: A Survey of \Making Shocking Looks\ Cosmetics Item - 2

Picking the Right Doctor prescribed Medication Inclusion in Senior Protection.

Picking the Right Doctor prescribed Medication Inclusion in Senior Protection. - 3

Exploring Programming Greatness: A Survey of \Easy to use Connection points\

Exploring Programming Greatness: A Survey of \Easy to use Connection points\ - 4

A Couple of Modest Guitars for 2024

A Couple of Modest Guitars for 2024 - 5

Computerized Strengthening d: A Survey of \Upgrading Efficiency\ Programming Application

Computerized Strengthening d: A Survey of \Upgrading Efficiency\ Programming Application

Share this article

Insane Realities That Will Make You Reconsider How you might interpret History

Insane Realities That Will Make You Reconsider How you might interpret History The most effective method to Guarantee Scholastic Honesty in Web-based Degrees

The most effective method to Guarantee Scholastic Honesty in Web-based Degrees The Solution to Flexibility: Developing Internal Fortitude Notwithstanding Misfortune

The Solution to Flexibility: Developing Internal Fortitude Notwithstanding Misfortune Evaluated Smartwatches for Wellness Devotees

Evaluated Smartwatches for Wellness Devotees Incredible Shows to Long distance race on a Plane

Incredible Shows to Long distance race on a Plane Top Colorful Organic products: Which One Might You Want to Attempt?

Top Colorful Organic products: Which One Might You Want to Attempt? Step into Nature: A Survey of \Handling Trails with Solace\ Climbing Shoes

Step into Nature: A Survey of \Handling Trails with Solace\ Climbing Shoes Find the Wonders of the Silk Street: Following the Antiquated Shipping lanes

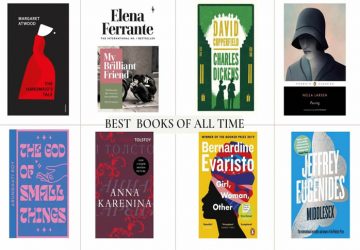

Find the Wonders of the Silk Street: Following the Antiquated Shipping lanes The 15 Most Compelling Books in History

The 15 Most Compelling Books in History